Optimists

What is the face of pure speculation? Optimists have reigned in my trading lifetime.

The signs of speculative excess are obvious. And those excesses are everywhere to be found. But the bulls still buying stocks may well be right. They believe the rolling correction of the last year burnt out the excesses. Maybe. Or maybe not.

On January 6, 2022, I typed words of calm (via a Tweet @robertqwatson61) into the vast conspiracy of doom sweeping across the crypto-currency markets. “The nature of markets, due to the humans involved is CYCLICAL. Nothing goes straight up, or down unless it’s going bankrupt. Bitcoin was a bubble #cryptocrash and it popped. A buying opportunity will appear. Patience.”

I wasn’t being an optimist. Even though by nature I am very optimistic. In the markets, I am a raging pragmatist. The sun will rise again and buyers will emerge in the greatest of storms.

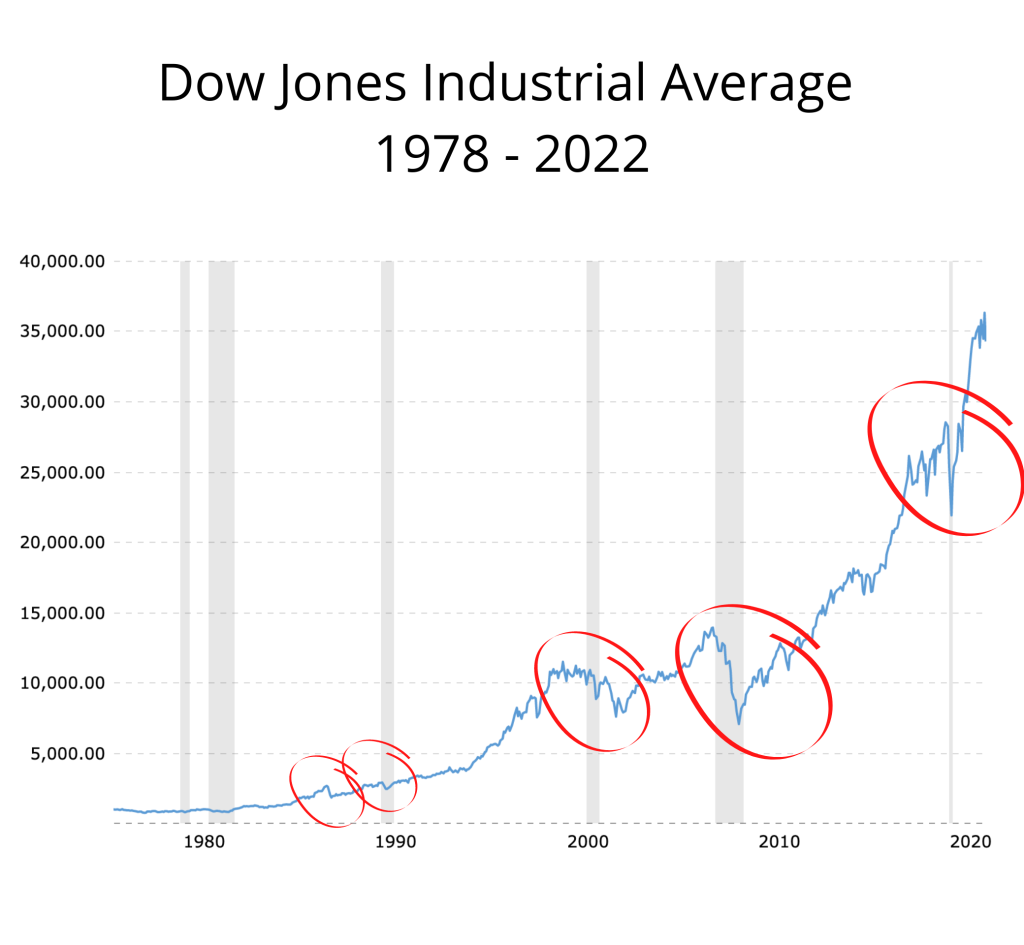

I have survived the crashes of 1987, 1989, 2000, 2008 & 2020. The sun rose every morning, and eventually, buyers bought into the markets. The two charts below depict the Dow Jones in my lifetime of trading. A respectable 40 plus years. The gray-shaded timeframes represent recessions to put the economic world into context.

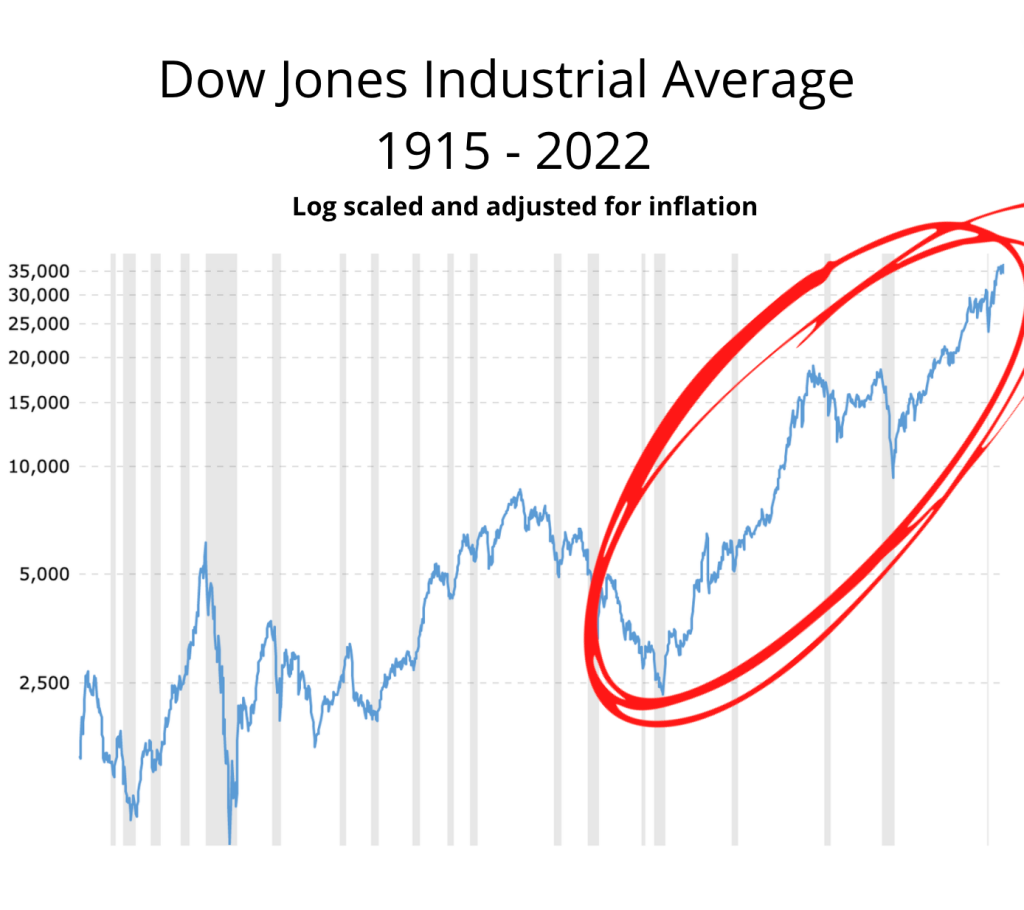

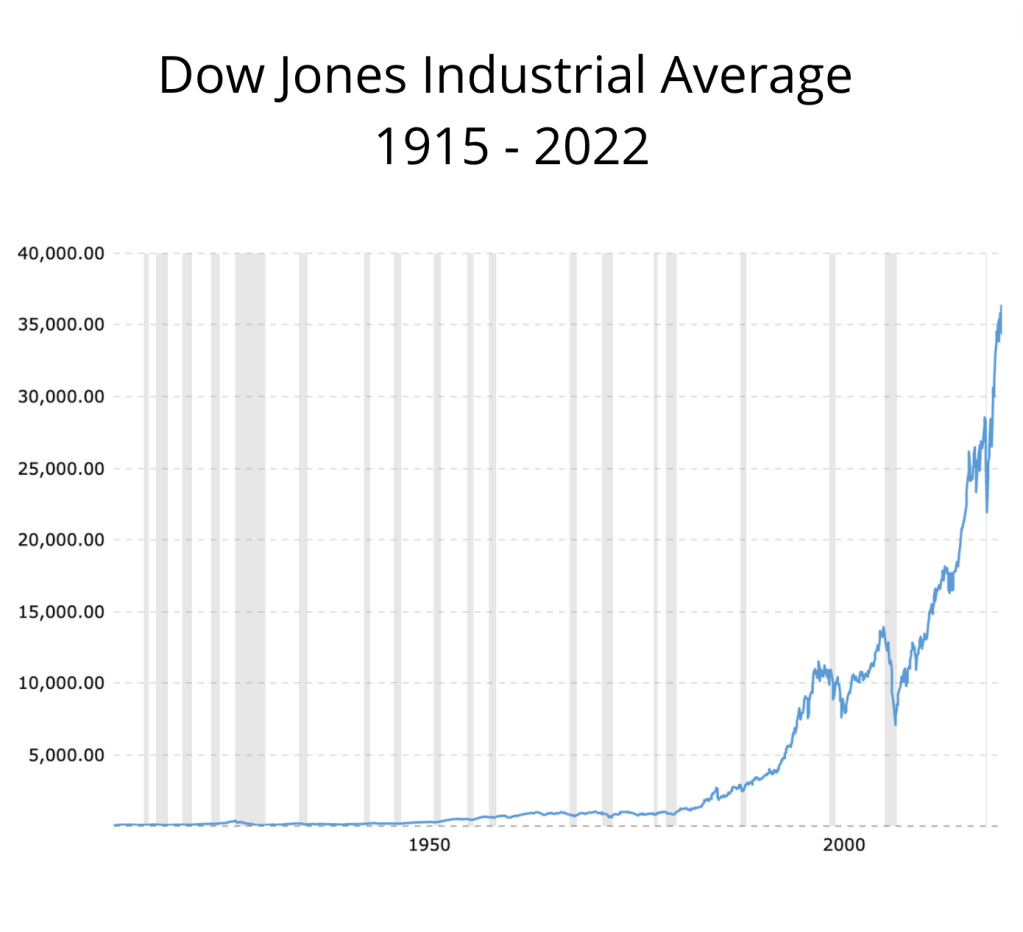

Even adjusted for inflation, the Dow Jones Industrial’s 30 stocks have had a good run no matter how you slice the data picture. Going back to 1915, the historic picture gets a little fuzzier. My trading lifetime appears to have been the best slice of over 100 years of trading.

Unadjusted for inflation and log scale, the DJIA is a hockey stick. (see below) A meteoritic rise since WWII, plainly justified by America’s place in the post-war economic realm.

Adjusted for inflation the rise is a bit tamer. (see below) But only a little. The fact is the DJIA’s rocket ride coincided with my trading tenure colors my worldview. Which leads me to a very sobering conclusion. What goes up, will come down. The markets are cyclical. And please note the DJIA’s run from 1980 to 2022 matches the baby boom generation’s peak earning years. But alas the baby boomers are taking money out of the market for retirement.

The question on everyone’s mind is simple. Is this DJIA move through 36,000 another bubble, like cryptocurrencies? Obviously, it is absolutely ridiculous to compare an insurgent technology like Bitcoin with the 30 largest, best run, and most stable companies in the world. There is no practical financial comparison. But there is a behavioral similarity in speculative excesses that form, foment, and trigger financial bubbles.

In an article for Bloomberg entitled, “A Moment of Reckoning on Financial Literacy” author Charlie Wells says, “We are living in a new era of investing. Meme stocks, cryptocurrencies, NFTs, SPACs, and even ETFs have over the past few months attracted tens of millions of new traders, drawn in with a mix of stimulus money, easy brokerage apps, and pandemic-era boredom. Those traders are passionate, sometimes very you, often belong to devoted online communities and in some cases have been very financially fortunate. “

“That doesn’t mean they’re financially literate. Experts have warned since the beginning of the latest retail mania that many new entrants are conflating investing with speculating. The difference can at times feel hazy, particularly at a moment when perspectives are shifting. “

Wells nails the attempt at paradigm rationalization where investing and speculation blur. In reality, the two notions rarely intersect but in only the most abstract heat of the moment sense. The post-mortem on this behavioral excess never varies. The wisdom of the crowd is just wrong at major turning points in the markets.

As someone who has traded through five stock market crashes, the similarities are striking. Please take a moment to read through my posts on Bitcoin on September 16, 2021, October 10, 2021, and November 26, 2021. I read the crowd price action of Bitcoin, nothing else. May I suggest at these lofty levels on the DJIA and S&P 500, let Caveat Emptor, buyer beware be your watch phrase? I offer my sobering assessment with J.P. Morgan’s father’s advice ringing in my head.

“…never do anything to cause evil to be spoken of the American name.” Junius Spencer Morgan I (April 14, 1813 – April 8, 1890) That phrase has been echoed forward, “as don’t ever bet against your country.” I agree with the more senior Mr. Morgan. I like the way Americans come back from hardship. Americans battle.

Is a stock market correction coming? Absolutely. I will be on the lookout for the signs of trouble. However, in the long run, I am not betting against the industrious nature of the average American.