Okay at 128K

A recent survey of more than 2,000 people found Americans with “a dwindling sense of financial confidence. But well-being can be bought for $128K.

The following story is making the press rounds for its eye-popping claims.

Americans Say They Need to Earn $128,000 to Feel Financially OK This piece was written by Bloomberg’s Suzanne Woolley. “Feeling financially healthy means pulling down a six-figure salary, according to a survey by Personal Capital and Harris Poll.” Ms. Woolley does her job by quoting a typically reliable source in The Harris Poll.

“The average amount American adults said they’d need to earn to feel in good financial shape was $128,000, the survey showed. That’s far from the median U.S. household income in 2020 of $67,521, according to the U.S. Census Bureau. The survey of more than 2,000 people found Americans with “a dwindling sense of financial confidence.” In 2021’s final quarter, 34% of respondents said they felt financially healthy, compared with 48% in early 2021.”

My challenge with the assertions from the Harris Poll (on earnings & being okay) is the lack of transparency in delivering the results. I don’t know the questions asked or where Harris found the survey respondents. I can’t find the raw study to hang my hat on.

But I do have a massive Wharton study released in 2021 drawing on 1,725,994 experience-sampling reports from 33,391 employed US adults for comparison.

But first, The Harris Poll completed another study in 2017 relevant to our discussion. According to a US study of 1,000 adults 18+ conducted in April 2017. The Enabling the Good Life Report from Sustainable Brands and Harris Poll shows the dramatic shift in American attitudes and reflects a gap between people’s new aspirations and the ways business responds.

There is an emerging desire for balance with two leading themes driving the new definition of the Good Life:

Meaningful Connections: 76% believe the Good Life is defined by having meaningful engagement with families and their communities, including those in need and the environment.

Balanced Simplicity: 66% believe the Good Life is defined by having good health and living a simple, yet balanced life. Americans are seeking reduced complexity and healthy behaviors – striking a tone of moderation, all actions contributing to their happiness.

Financial independence (26%) and personal goals (10%) such as career and education trailed balanced simplicity (36%) and human connections (28%) in what Americans view as the most important factors in defining the Good Life.

While income (62%) is reported as a top obstacle preventing The Good Life, more than 3 in 4 Americans (78%) believe money cannot buy happiness.

Happiness is the state of being happy. Not a very useful definition. Let’s try happy.

Happy is feeling or showing pleasure or contentment. I can live with pleasure or contentment as an answer. Can we all agree that “contentment” is synonymous with the “Good Life” and close to the terms being “okay”, “life satisfaction” or “well-being?” Lord knows I love the social sciences for all the opaque jargon. I miss the days of the Roman Coliseum where the Gladiator got a thumbs up or down. Live or die. Not an assessment of his well-being on the contentment scale.

According to the 2017 Harris Poll, money does not equal happiness. Cool. An easy formula. Got it. Even though according to the same Harris Poll, almost 2/3 of the respondents cited income or money as the major obstacle to the “Good Life”? Hmm?

Both of the Harris Polls were small samples and the questions asked lacked the specificity I noted above in the “reconciling the jargon section.” Now let’s look at the 2021 Wharton Study by Matthew A. Killingsworth testing prior research which found that well-being does not increase above incomes of $75,000/y. Confirming the Harris Poll thesis that money does not equal happiness.

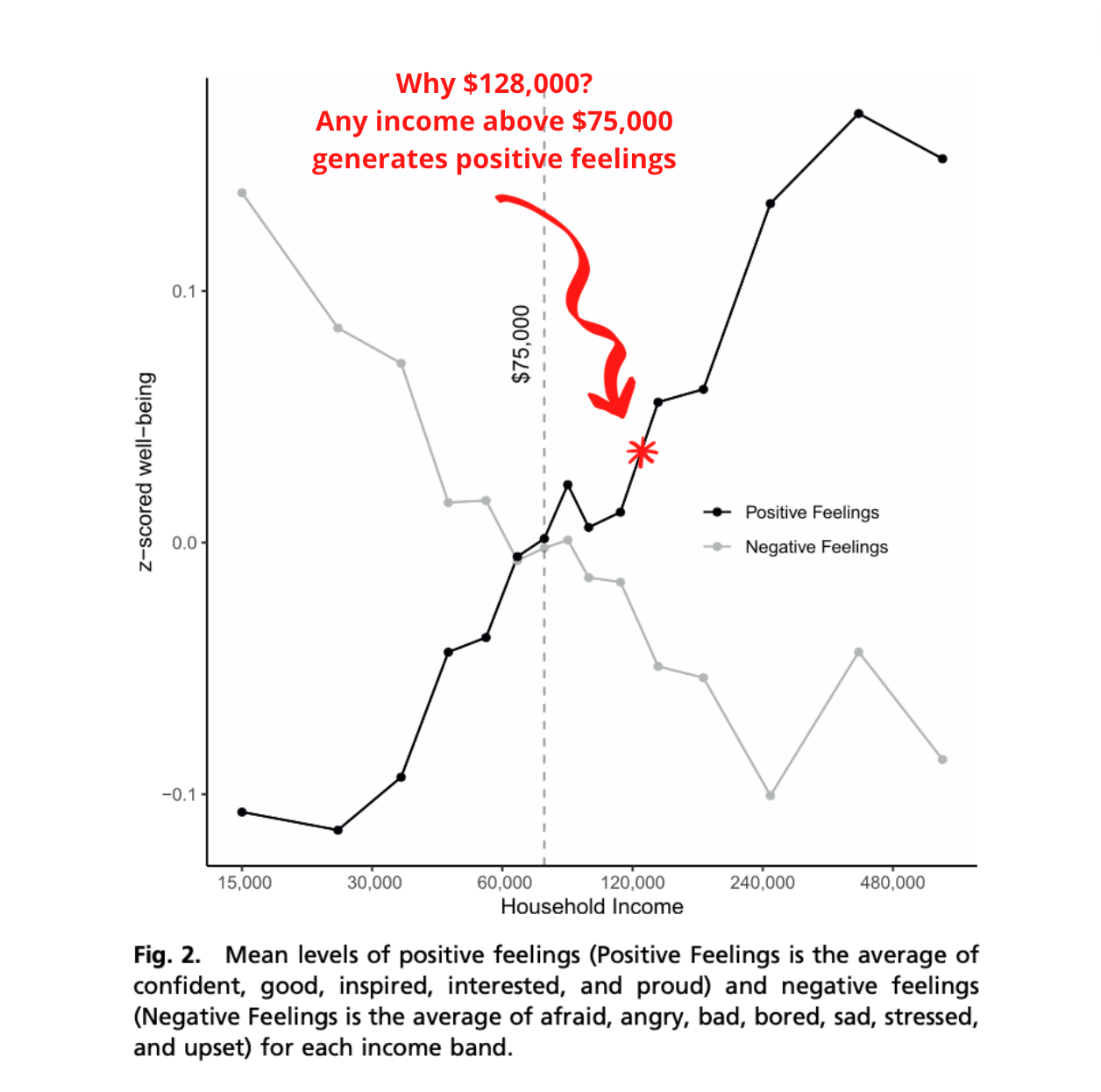

However, Killingsworth’s study using 1,725,994 experience-sampling reports from 33,391 employed US adults found a different result. The feelings of well-being continued to rise beyond $70,000 a year with no plateau in sight. Figure 2 below, hammers the point home.

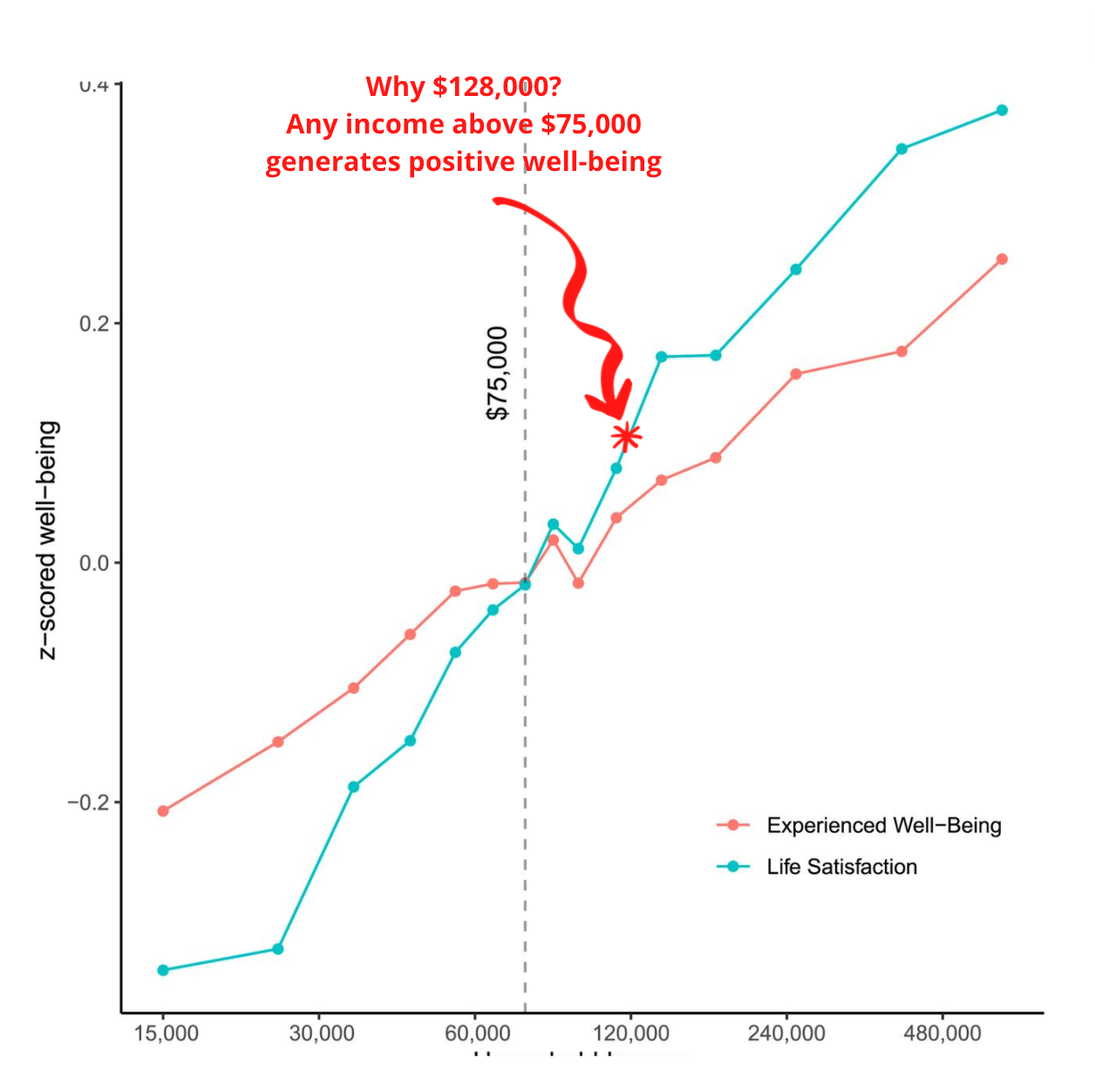

Figure #3 below brings the “money does not equal happiness” thesis into serious question. Or does it?

Figure #3 Life Satisfaction and Experienced Well-being

Let me offer a different hypothesis drawn from my 43 years of adulthood. My parents, who were raised in the great depression saw money differently than me. My adult children see money differently than me but not like my parents. Could the research completed over the last two decades be influenced by a generational shift in thinking?

Beyond the Hype’s 3rd Maxim is “Experience causes bias & blindspots – we see the world, not as it is, but as we are.”

Each generation in my family sees the world as they are, not as it might be. That bias bleeds through the data sampled and collected. Also, who wants to admit to being that guy or gal valuing money and its security over a connection with people, the environment, and family.

I would be wary of letting eye-popping numbers like $128,000 a year influence you or allow it to set your financial thermostat. Big media has a model to pay their bills. It involves drawing attention and creating friction through the selective use of fiction. The moral of this post is to sort out your own tradeoffs between money and what truly matters to you. And be careful of media pronouncements describing the state of our culture or your peers, as you might be listening to more fiction than fact.

Until next time, travel safely.