Inflation's Peak?

Uncertainty creates a firestorm of negative consumers. Nearly half of Americans reported using rising prices as a pretext for delaying buying decisions.

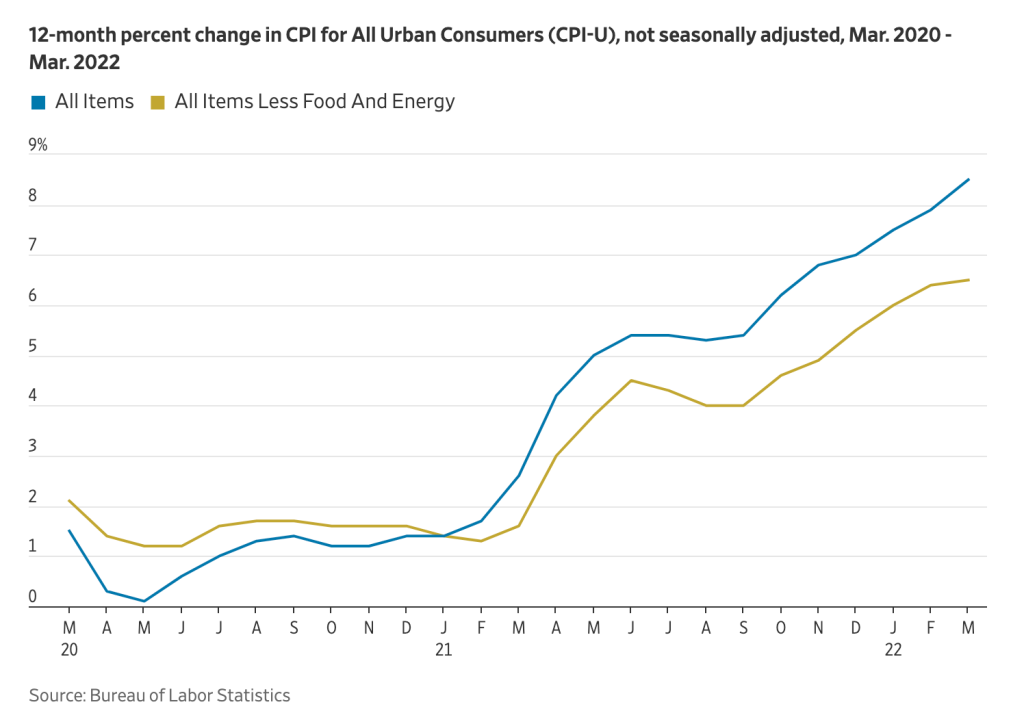

U.S. consumer prices rose in March by the most since late 1981, underscoring the painfully high cost of living and reinforcing pressure on the Federal Reserve to raise interest rates even more aggressively. Bloomberg’s chart below suggests the hockey stick in prices is a not-so-subtle repeat of the late 1970s, an era that strikes fear in the heart of political leadership. Fed Chairman Volcker’s prescription for choking off the last inflationary spiral hurt the economy in a myriad of ways. I was there. It was not pretty. Our economy was rocked and reshaped from real estate to manufacturing as the FED tightened to whip inflation.

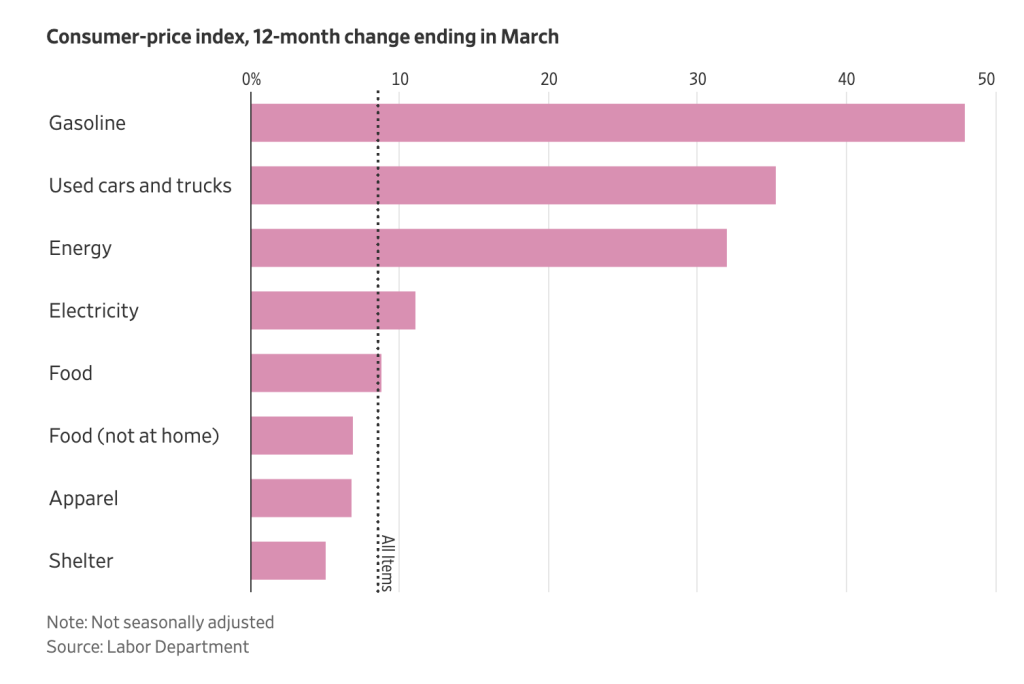

I argued last October, prior to Russia’s invasion of Ukraine that energy would make inflation prices sticky going forward. Specifically, I said, “Without sparking an ideological squabble, I believe we can all agree that energy prices are nestled in the costs of most everything. At the bare minimum raw materials, intermediate products, and consumer goods have to be transported. Not to mention energy costs associated with manufacturing. Higher energy prices mean higher costs of production and transportation. Producers and manufacturers will attempt to pass on the price increases to the consumer. Meaning you and I will pay more at the point of sale.”

Political buck-passing will not work with energy prices. The rise in energy was already baked into the cake at the end of last year. (see chart below)

The rising cost of gas, food, and hundreds of other things is pushing Americans to rethink price tags. Whether in the supermarket or a car lot, our definition of cheap or expensive has changed, consumer psychologists say.

Inflation turns our dollar into a Monopoly money. Quick.

Americans trimmed spending and adjusted their monthly budgets as the annual inflation rate rose to a four-decade high of 8.5% in March, the Bureau of Labor Statistics said Tuesday. Financial advisers say this recalibration can’t be a one-time effort. Knowing exactly what you are willing to pay for something and examining what is a necessity should be a constant effort.

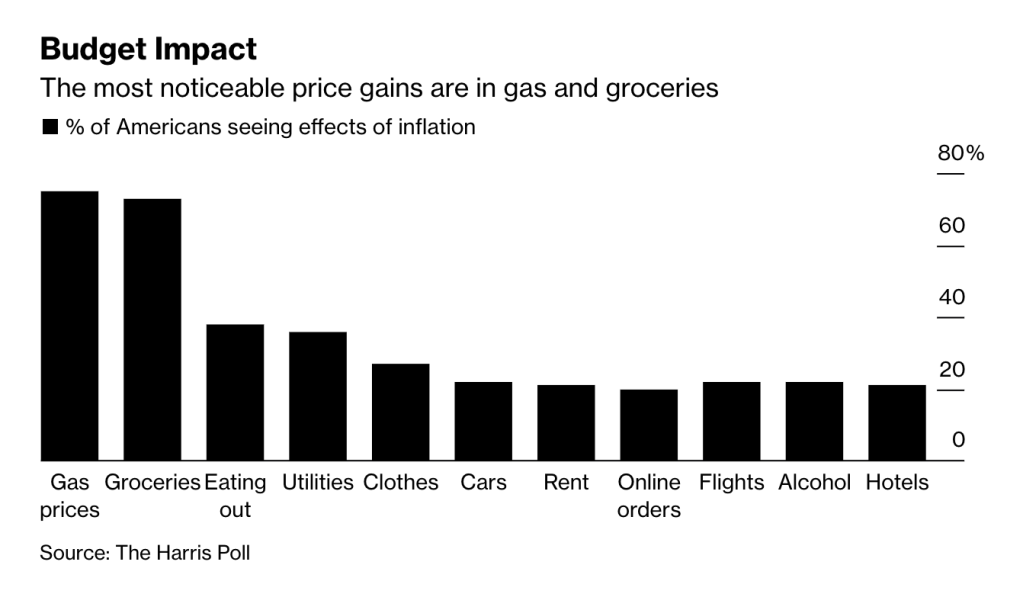

The sudden inability to comprehend price tags is disorienting to those under age 40, who have never experienced anything like today’s inflation rate. Understanding how we think about price uncertainty in the future becomes an essential tool for making our way forward as consumers. Big purchases feel particularly unpredictable. (see a Harris Poll results below in the graphic) A lack of certainty means less spending on houses, cars, and vacations. But any COVID-19 deferred spending could keep the economy humming.

Uncertainty creates a firestorm of negative consumers. Nearly half of Americans reported using rising prices as a pretext for delaying buying decisions. (see pie chart below) Strikingly, 51% of high-income households say they have used inflation as an excuse even if higher prices were not actually an issue, compared with just 44% of low-income households.

At home, 53% of couples say inflation is prompting them to talk about money more often with their partners. A third say that rising prices have had a negative impact on their relationships.

Price increases are revealing the spending choices Americans are willing to make relative to others as well — and it seems pets rank higher than humans. Some 71% of respondents say they are likely to sacrifice the quality or quantity of spending on goods for themselves due to inflation. That number fell to 56% when it came to people’s spouses or partners, and just 48% said they would sacrifice quantity or quality when spending on their animals.

Rising prices largely have a negative effect on Americans’ quality of life, yet 57% say they see some upside. Over a third cite cutting back on impulse purchases as a benefit. Around 21% see a benefit in increased pay, while 18% say it makes debts easier to pay off.

Our very own spin doctors went to work blaming Russia’s Putin for inflation. He is not helping matters, but he does not get the blame for this little travesty.

In an op-ed piece in the Wall Street Journal, the writers offer this insight, “the nearby chart shows that the inflation trend began in earnest a year ago at the onset of the Biden Presidency. It has accelerated for most of the last 12 months. That was long before Mr. Putin decided to invade. The timing reflects too much money chasing too few goods, owing mainly to the combination of vast federal spending and easy monetary policy.”

Mr. President, you have to own this one. Oil rose from around $40 to $80 before there was a whiff of a Russian invasion. I articulated my thoughts in my post “Inflation” in October last year, and “What is Inflation?” in December. Inflation was coming and it was going to be the sticky kind that is difficult to shake.

Energy’s large rise over the last year is a function of policy and perception of policy. US Oil rig count is the ultimate tale of the tape with regard to policy. With $100 crude, the rig count is 60% of its highs five years ago. Those nasty oil company capitalists are passing on $100 crude? Hmm.

I see more economic trouble is ahead. Persistent inflation is not a net positive for the average American.

Until next time. Travel safe.