From Russia with Love.

silver (Ag), a chemical element, is a white lustrous metal valued for its decorative beauty and electrical conductivity.

Always on the lookout for the odd piece of intelligence, I spied a Financial Times report detailing a Bank of Russia warning about the state of the global economy. Instead of tailgating on Saturday, I found myself on the Russian central bank’s website. The site is easy to navigate and fortunately, with my Russian skills continuing to perish with the ravages of time, I had the option of surfing in English. Why do I speak sputnik? Well back in the day, I was a cold warrior nose to nose with President Reagan’s evil empire. But that is a story for another time.

Russia’s central bank says a financial crisis on the scale of the 2008 collapse could happen in less than 18 months if the global inflation genie escapes the bottle. The report said that global gross domestic product growth could slow to just 1.1 percent as higher interest rates prompted investors to dump risky assets. Emerging market countries with high levels of foreign debt would be particularly affected.

“Risk premiums will increase significantly, the most indebted countries will struggle to service their debt, and a significant financial crisis will begin in the global economy in the first quarter of 2023 — one comparable to the 2008-2009 crisis, with a long period of uncertainty and a protracted recovery,” the central bank said.

In the same breath, the Bank of Russia minted a silver coin as currency. The Bank of Russia issued an investment-grade silver 3-ruble coin ‘Saint George the Victorious’ (Catalogue No. 5111-0178). The investment silver 3-ruble coin (fine metal content 31.1 g, fineness 999/1,000) has a round shape and is 39.0 mm in diameter.

The reverse of the coin features a relief image of the National Coat of Arms of the Russian Federation and the inscriptions: ‘РОССИЙСКАЯ ФЕДЕРАЦИЯ’ (RUSSIAN FEDERATION), ‘БАНК РОССИИ’ (BANK OF RUSSIA), the coin denomination ‘3 РУБЛЯ’ (3 RUBLES), the year of issue ‘2021 г.’ (2021), the chemical symbol of the metal according to Mendeleev’s Periodic Table of Elements, fineness, the mint trademark, and fine metal.

The coin is minted in uncirculated quality. The mintage of the coin is up to 500.0 thousand pcs.

The key language in the Bank of Russia’s release, “the new coin is legal tender of the Russian Federation and is mandatory for acceptance for all kinds of payments without any restrictions at its face value.”

Interesting timing. Maybe not. Holding Russian rubles has been a dicey bet since the Russian Federation emerged from the old Soviet Union. The ruble began trading in June of 1994 at 2.67 rubles to the dollar. The ruble closed trading on Friday, September 2, 2021, at 72.745 to 1.

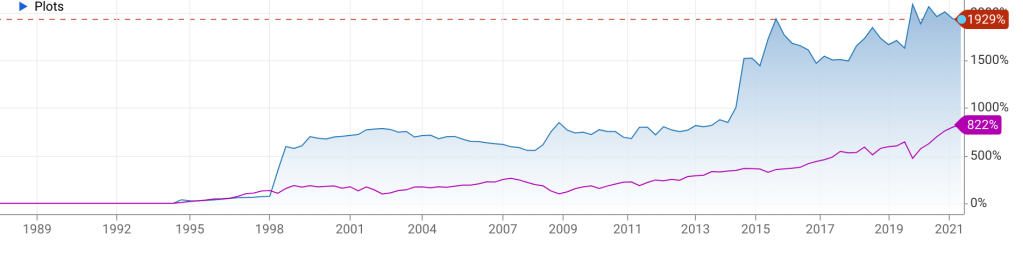

The dollar has risen 1929% against the ruble since 1994. The Dow Jones Industrial Average by comparison has risen only 822% over the same time period. Though uncirculated, the new Russian silver coin has investment appeal for the average Russian. A much better play than holding Rubles.

The Bank of Russia’s move is oddly timed. If I were a senior-level strategic analyst on the Russian desk, and I am not, I would say the Russians are preparing for a spike in inflation and/or they are getting ready to make a move on Ukraine. But who am I?