A Minsky Moment.

Minsky argued that financial crises are endemic in capitalism because periods of economic prosperity encouraged borrowers and lenders to be progressively reckless. This excess optimism creates financial bubbles and later busts.

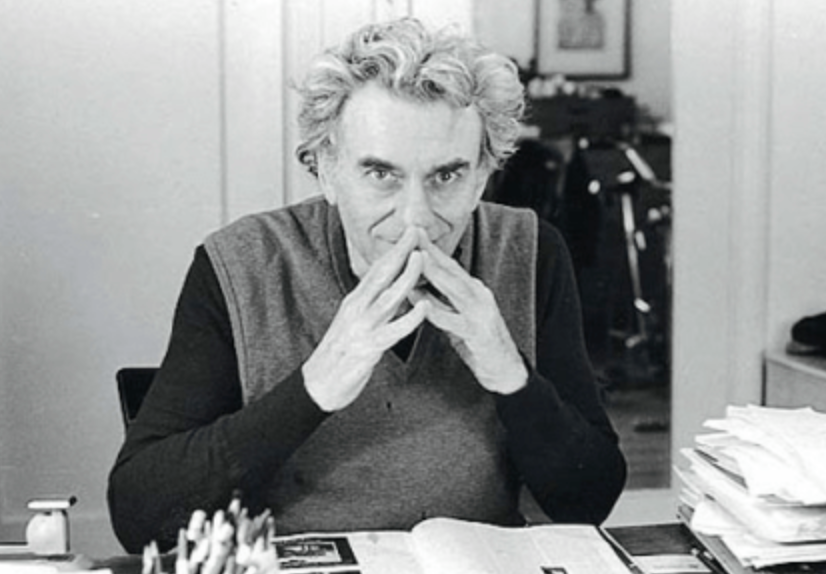

This morning I was having coffee with an economist relishing his pearls of wisdom. His name is Hyman Minsky. Dr. Minsky passed in 1996, so it was his written legacy that kept me company. The late economist is best known for his “Minsky Moment”, referring to the onset of a market collapse brought on by the reckless speculative activity that defines an unsustainable bullish period. Propped up solely by speculation at a fragile tipping point, a sudden decline in market sentiment inevitably causes a market crash. A sort of financial end of days.

Considering the end of days, my thoughts drifted. Recently, I stumbled across a research piece “An Analysis of the Potential for the Formation of ‘Nodes of Persisting Complexity’” by Nick King and Aled Jones (July 2021). Their work produced a shortlist of nations (New Zealand, Iceland, the United Kingdom, Australia, and Ireland) identified and qualitatively analyzed in detail to ascertain their potential to form ‘nodes of persisting complexity’ (New Zealand is identified as having the greatest potential). In terms I can relate to, their research identified the best places to survive and thrive in a societal collapse.

Each country was qualitatively assessed for its individual, local-scale (primarily energy and agricultural) characteristics. This identified New Zealand as having the greatest potential to form a ‘node of persisting complexity’, with Iceland, Australia (Tasmania), and Ireland also having favorable characteristics. According to the researchers, the United Kingdom presents a more complex picture and potentially has less favorable characteristics overall. Who would have guessed that islands with plenty of food, water, and energy would be havens for a societal collapse?

My brother Michael lives in Australia. Maybe I should grab my duffel bag and head his way. I have always wanted to dive into the Great Barrier Reef.

Back to our here and now, Hyman Minsky’s postulation of financial tipping points proved to be right in 2000 with the Dot. coms and 2008 with the mortgage excesses. I am fairly certain Minsky would see our current reality with meme stocks, negative interest rates, and the crypto craze, as prime for another tipping point. Timing is always tough to gauge, but my duffel bag is packed and my brother, Michael is on speed dial. I wonder how he feels about having guests for a long stay?

Until next time. Stay safe.